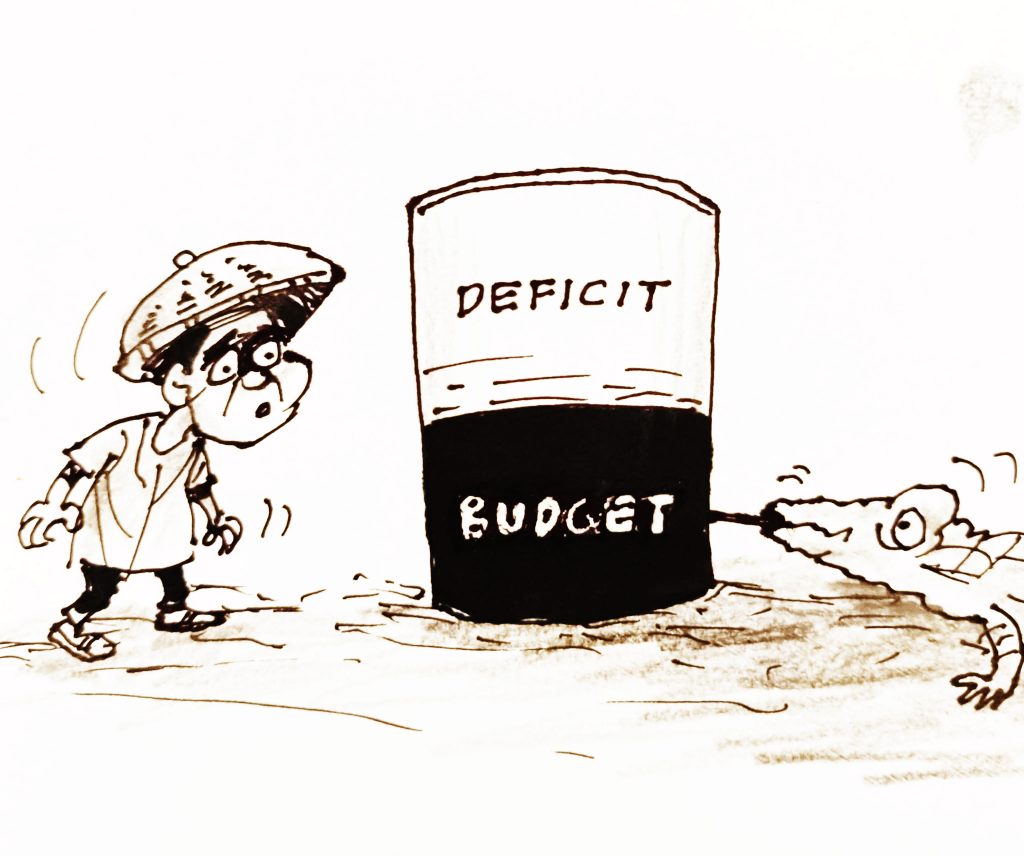

A reported 200-billion-peso budget shortage now confronts the current administration. This fiscal gap is alarming, but it should never have reached this scale in a government long plagued by corruption. Public funds do not vanish on their own; they are lost through systems that allow them to be stolen.

For decades, corruption has drained the national treasury through padded contracts, ghost projects, rigged procurements, and discretionary funds shielded from scrutiny. Every overpriced bridge, every unfinished flood-control system, and every anomalous supply deal has quietly carved away at the nation’s finances. When billions are siphoned off annually, a 200-billion-peso shortfall is not surprising—it is the cumulative result of tolerated malpractice. Budget deficits are often blamed on global conditions or revenue shortfalls, yet the deeper hemorrhage lies within.

The scale of public spending in a country like the Philippines runs into trillions of pesos each year. Even a small percentage lost to corruption translates into staggering amounts. If ten percent of major infrastructure allocations are misused or stolen, that alone could equal or exceed the reported shortage. The issue is not merely inefficiency but impunity. Without credible consequences, corrupt practices become routine, embedded in procurement systems, local government transactions, and even national agencies.

This shortage also exposes a moral failure in governance. Taxes are collected from workers, entrepreneurs, and overseas laborers in exchange for the promise that the state will deliver services—education, health care, infrastructure, and security. When funds are stolen, the burden is shifted back to the public through higher borrowing, new taxes, or reduced services. It is unjust to ask citizens to tighten their belts while corrupt officials enrich themselves. Fiscal crises should not be used to justify austerity when the real problem is leakage at the source.

The government must pursue a decisive recovery of stolen assets, aggressively prosecute corruption cases, ensure strict transparency in procurement, and implement an empowered auditing system insulated from political pressure. Asset forfeiture laws must be enforced without exception, and lifestyle checks must become standard practice. Digital tracking of public expenditures, open contracting data, and citizen oversight mechanisms should be institutionalized. When public funds are protected with seriousness and discipline, budget gaps shrink—not because of new taxes or loans, but because the nation finally keeps what rightfully belongs to it.